The Texas land market continues to stand out as one of the most dynamic in the “Land of America.” Even in an era of rising interest rates and economic uncertainty, demand for land in Texas remains resilient. Fueled by population growth, corporate relocations, and a strong agricultural and energy base, the Lone Star State’s land sector has not only weathered national slowdowns — it has outperformed most of the country.

In 2025, buyers are increasingly looking beyond urban centers, favoring rural and suburban plots that offer more space, flexibility, and long-term value. This shift is particularly evident in areas like Hill Country, West Texas, and the Gulf Coast, where demand is driving steady appreciation.

Key Economic Drivers Influencing Texas Land Values

Population Growth and Migration Patterns

Texas remains the top destination for domestic migration in the U.S., attracting over 400,000 new residents annually. Many come from high-cost states like California and New York, seeking affordable land, lower taxes, and better quality of life.

Corporate Relocations and Job Creation

Major corporations such as Tesla, Oracle, and Hewlett Packard Enterprise have relocated or expanded in Texas, bringing thousands of high-paying jobs. This has fueled housing demand and increased the value of nearby land.

Agricultural and Energy Sector Impact

Texas leads the nation in cattle production, cotton exports, and wind energy generation. These industries maintain strong demand for agricultural land, while oil and gas exploration keeps certain West Texas markets attractive for mineral rights investors.

Regional Land Trends Across Texas

North Texas and the DFW Growth Corridor

Land in the Dallas–Fort Worth metroplex and surrounding counties continues to command premium prices, averaging $18,000 per acre in 2025, with projections reaching $24,000 by 2030. Rapid population growth and infrastructure expansion are key drivers.

Hill Country Lifestyle Demand

Hill Country’s scenic views and booming wine industry make it one of the most sought-after regions. Prices have grown from $15,000 per acre in 2020 to $21,000 in 2025, with a projected 2030 value of $28,000.

West Texas Affordability

While more remote, West Texas offers some of the most affordable land in the state, averaging just $5,000 per acre in 2025. This region appeals to large-scale ranchers and budget-conscious investors.

Gulf Coast and Coastal Bend Appeal

Coastal properties have surged in value due to tourism and retirement migration. Prices average $14,500 per acre in 2025, with a projection of $19,000 by 2030.

Texas Land Price Trends

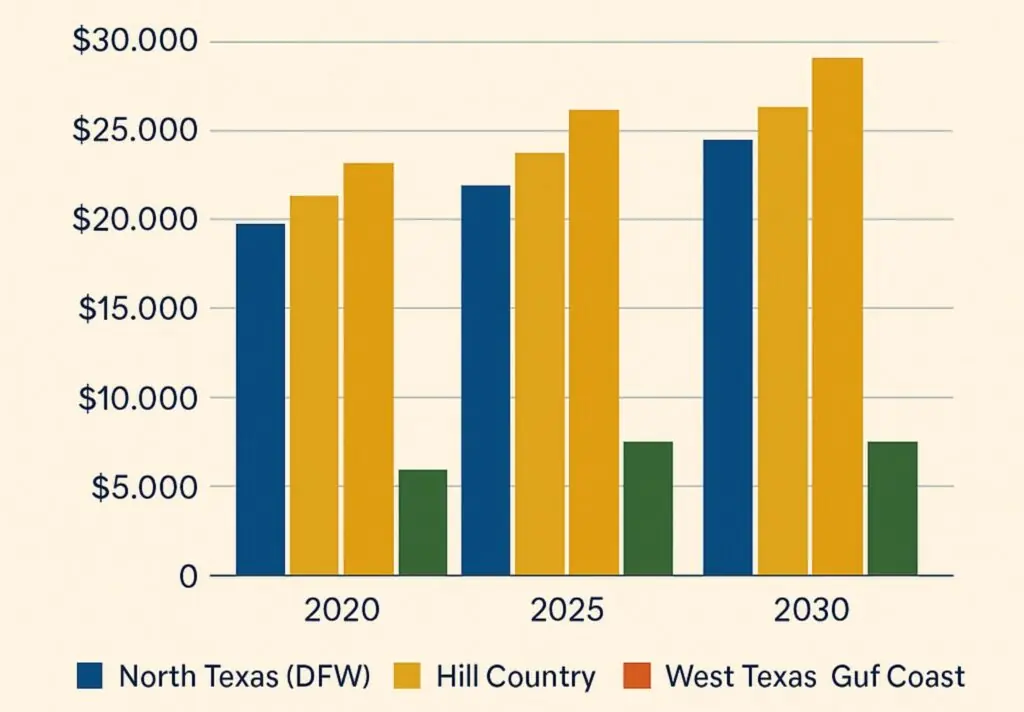

The following table and chart summarize recent and projected Texas land prices across major regions:

| Region | 2020 Price per Acre ($) | 2025 Price per Acre ($) | Projected 2030 Price per Acre ($) |

|---|---|---|---|

| North Texas (DFW) | 12,000 | 18,000 | 24,000 |

| Hill Country | 15,000 | 21,000 | 28,000 |

| West Texas | 3,500 | 5,000 | 7,000 |

| Gulf Coast | 10,000 | 14,500 | 19,000 |

The chart clearly shows steady upward momentum, with Hill Country and North Texas leading in price growth, while West Texas remains the most affordable entry point.

Buyer Segments and Their Impact on the Market

Residential Buyers and Homesteaders

Increased interest from remote workers has pushed demand for rural and semi-rural land where buyers can build custom homes or start small farms.

Agricultural Buyers and Ranchers

Cattle ranching and crop farming still dominate rural economies, with many buyers seeking large tracts for both commercial and family use.

Investors and Developers

Developers target suburban fringes, while investors focus on undervalued land with long-term appreciation potential.

Challenges and Risks in the Texas Land Market

Infrastructure Limitations in Rural Areas

While affordable, many rural properties lack paved road access, utilities, or broadband, requiring extra investment before development.

Zoning and Development Restrictions

Counties vary widely in zoning laws, which can limit building options for buyers unfamiliar with local regulations.

Climate and Water Availability Concerns

Drought risk in certain regions, especially West Texas, can impact agricultural potential and long-term land value.

Investment Outlook for Texas Land

Short-Term Opportunities

West Texas and select Gulf Coast counties remain undervalued compared to their growth potential. Investors can secure acreage at low prices today with expectations of steady returns.

Long-Term Appreciation Potential

Historical trends suggest Texas land values will continue rising over the next decade, particularly in high-growth corridors like North Texas and Hill Country.

Texas in the Land of America Market

Among all states in the Land of America network, Texas consistently ranks in the top three for land sales volume, appreciation rates, and diversity of offerings.

Texas remains a powerhouse in the Land of America market. Whether you’re a homebuilder, rancher, or investor, the state offers a unique blend of affordability, economic opportunity, and appreciation potential. With strategic selection and awareness of local market conditions, 2025 could be the ideal time to secure your stake in the Lone Star State. Consult our office for your land investments.